Safety measures for internet banking

The Internet has made revolutionary changes in the life of people around the world, this witnesses the waythey interact with other people and conduct business. With the evolution of Internet technology, electronic commerce has also developed which allows businesses to more successfullyand efficiently interact with their customers and other corporations inside and outside their industries.

One industry that is using this new communication channel to contact its customers is the banking industry. E-Banking is a collection of all the possibilities of banking whereby banking clienteles can avail the benefits of major services offered by a commercial bank at an offsite location with the support of Information and Communication Technologies.

Internet banking, a major component of e-banking framework, has changed the dynamics of commercial banking worldwide by almost bringing the entire banking set-up at the doorstep of a common banking client. The banking industries is a business that is using this new communication media to offer its customer the value added service and convenience.

Internet banking, a major component of e-banking framework, has changed the dynamics of commercial banking worldwide by almost bringing the entire banking set-up at the doorstep of a common banking client. The banking industries is a business that is using this new communication media to offer its customer the value added service and convenience.

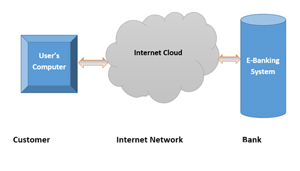

This system of interaction between the consumers and the banking industries is called the electronic banking system. "Electronic banking is the practice of a computer to recover and process banking data (statements, transaction details) and to initiate transactions (payments, transfers, requests for services, etc.) directly with a bank or other financial services provider remotely via a telecommunications network".

Though Internet banking is highly advantageous for customers but it is very complicated and poses challenges to banking organizations. The electronic banking system addresses several evolving trends: customers' demand for anytime, anywhere service, product time-to-market imperatives and increasingly complex back-office integration challenges.

The challenges that oppose electronic banking are the concerns of security and privacy of information.It has been observed that online banking is technical progression and it is safe if users take some precautions. Electronic banking is a new industry which permits people to interact with their banking accounts via the Internet from virtually anywhere in the world. This system allows consumers to access their banking accounts, review most recent transactions, request a current statement, transfer funds, view current bank rates and product information and reorder checks.

Today, internet banking is becoming more and more popular. Whether, customer has to pay bill, funds transfer or creation of a fixed deposit, internet banking allows them to do it in a fast and convenient way. Instead of going to the bank and waiting in a long queue, internet banking has made all banking functions reachable through a few clicks. Nevertheless, this facility needs to be used very cautiouslyas there are numerous risk involved in using such facilities, such as phishing, fraudulent means of attaining customer's confidential banking information. Since Electronic Banking is emerging technology that has many competences and also many potential difficulties, users are diffident to use the system. The use of Electronic Banking has brought many issues from different perspectives: government, businesses, banks, individuals and technology.

Major areas are:

- Security: Major worry of the Internet-based industries is Security of the transactions. The lack ofsecurity may cause serious damages. The examples of potential risks of the electronic banking system are duringon-line transactions, transferring funds, and minting electronic currency.

- Anonymity (Privacy): Second concern of internet banking is the privacy issue. By the establishment of privacy technology, itguarantees theconfidentiality of sender's personal information and further augments the security of the transactions. The examples of the private information relating to the banking industry are the amount of the transaction,the date and time of the transaction, and the name of the merchant where the transaction is taking place.

- Authentication: Encryption may assist to make the transactions safer, but there is also a need to assurance thatno one alters the data at either end of the transaction. There are two ways to verify the integrityof the message. One form of verification is the secure Hash algorithm which is "a check that protectsdata against most modification." The sender transmit the Hash algorithm generated data. Therecipient performs the same calculation and compares the two to make sure everything arrived correctly.If the two results are different, a change has occurred in the message. Another way of verification isthrough a third party called Certification Authority (CA) with the trust of both the sender and the receiverto verify that the electronic currency or the digital signature that they received is real.

- Divisibility: Electronic money may be separable into different units of currency, similar to real money. Forexample, electronic money needs to account for pennies and nickels.

Common safety measures for Internet banking:

Whenever customers use internet banking, they must take some precautions to prevent from fraudulent activities.

- It is recommended to change password regularly when using internet banking.When customer login for the first time to internet banking account, he will need to use the password provided by the bank. However, he must need to change this password in order to keep his account safe.

- Important safety measure is that customers must not use public computers to login. They should avoid logging in to their bank account at common computers in cyber cafes or libraries. These are congested places, and there are more chances of password being traced or seen by others. If there is urgency and customers have to login from such places, make sure they clear the cache and browsing history, and delete all the temporary files from the computer. Also, never allow the browser to remember their ID and password.

- It is always suggested by internet experts that customers must not share their personal details and sensitive information with anyone.Any bank will never ask for customer�s confidential information via phone or email. So whether customers get an apparent phone call from the bank or an email requesting their details, they should not give out their login information. It is advised that customers use their login ID and password only on the official login page of the bank, which should be a secure website. Look for 'https://' in the URL when logging in; it means that the website is secure.

- It is highly important for internet banking users to keep checking their savings account regularly and check account after making any transaction online. Always verify whether the right amount has been deducted from their account. If customers see any discrepancies in the amount, inform the bank instantaneously.

- Customers of internet banking must use licenced anti-virus software in order to protect computer from new viruses. Pirated versions of anti-virus software may be available for free, but they may fail to protect computer from new viruses prevalent in the online world. Furthermore, they will get notifications for updates in the software periodically. Make sure that customers keep anti-virus updated, so that their confidential information is always protected.

- Users must disconnect the internet connection when not in use. It has been observed that most broadband users do not disconnect the internet connection on their computer when they are not using it. Malicious hackers can access computer via an internet connection and hack confidential banking information. To keep data protected, ensure that users disconnect from the internet when they do not require it.

- Users should always type their internet banking URL.It is safer to type bank URL in the address bar of the browser instead of clicking on links given in an email. There are cases of swindlers sending emails with fraudulent websites links that are designed exactly like the bank�s original website. Once users enter their login details on such a website, they may be used to access their account and steal money. While logging on, check for 'https://' in the URL and ensure that it is your banks authentic website.

- Before entering personal information on a website, look for the "lock" icon in browser. A closed lock or padlock indicates that the website users are ona secure site.

It can be said that the Internet has evolved as an effective technology to facilitate people worldwide in doing their operations. There are more than 30 million users worldwide currently. The Internet improves the interaction between two businesses as well as between individuals and businesses.

Speedy growth of the Internet enabled the emergence of electronic commerce and offered great market potential for today's businesses. Among many industries, banking industry is highly benefited with internet technology. Electronic banking is offering its customers with array of services. Customers are able to interact with their banking accounts as well as make financial transactions from virtually anywhere without time limitations.

Electronic Banking is offered by many banking institutions due to pressures from market competitions. But at the same time it poses many challenges to user of inter banking.

Customers who use internet banking must do their financial transaction carefully and take some precautions to secure their money. Bank authorities and financial experts always advise to customers that they should not share their sensitive information, change password regularly and should not use internet in public areas. With such safety measures, users will get ease in doing money transaction and availing internet facilities.